Battery R&D Labs and Inflation Reduction Act

What you need to know

- The Inflation Reduction Act passed on August 16th, 2022.

- It allocates $369 billion to clean energy and energy security.

- The Act’s electric vehicle tax credits and clean energy production incentives should increase battery demand and R&D spending.

After nearly two years of debate and negotiation, the Inflation Reduction Act (IRA) became law on August 16th, 2022.

It implements landmark tax changes and spending programs, targeting a net federal deficit reduction of $300 billion over the course of a decade. Most of the Act’s expenditures aim to cut carbon emissions (hence its “climate bill” moniker) and improve energy security, while alleviating the household cost burdens of energy and prescription drugs.

Whether the bill can achieve its namesake goal of inflation rate reduction remains hotly debated. Many nonpartisan analysts, including the Congressional Budget Office, expect little to no impact in either direction. However, economists generally view deficit reduction (and consequently lower interest payments) as anti-inflationary.

Given that we supply several battery research facilities, we’re especially interested in the Act’s clean energy provisions. The rest of this article will share our initial expectations around consumer demand, credits/subsidies, and overall impact on the battery market in particular.

Battery Market Growth Projections

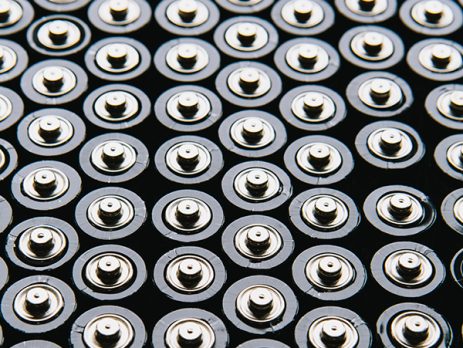

By virtually all accounts, the lithium-ion (Li-ion) battery market was already on track for massive growth through 2030.

Some market analysts place its current value as high as $42 billion globally, increasing to more than $182 billion by 2030—a 18% compound annual growth rate (CAGR). More optimistic estimates foresee a value of $193 billion by 2028, implying a 23% CAGR based on a value of $27 billion in 2020. Still others pin the electric vehicle battery market alone at $46 billion in 2021, and anticipate a staggering $560 billion value by 2030, implying a 32% CAGR.

Less discussed but potentially more disruptive is the solid-state battery market. Analysts foresee a CAGR of roughly 18% through 2030, catapulting its current value of $500 million to $3.4 billion. Arguably, the upside will be even greater if breakthroughs pave the way for solid-state technology in the already booming EV segment.

We are engineers, not market researchers, so we don’t endorse any particular forecast. Even so, all signs suggest that lithium-ion battery sales will multiply in value and in units over the next few years.

The role of electric vehicle demand

Electric vehicle (EV) sales have been and will remain a primary driver of battery demand.

EV incentives have been common since 2009’s stimulus legislation, and most locales offer a bevy of state and local programs on top of federal tax credits. Even without incentives, the market is poised to sail with the tailwind of existing demand, as would-be buyers look forward to supply chain normalization.

Industrial vehicles and off-highway equipment are also shifting toward battery power. From forklifts to excavators, several models are already in or approaching production. At an estimated $4.5 billion in 2028, this market is a drop in the bucket of overall EV demand, and may lag the consumer EV market for both technical and financial reasons.

The Inflation Reduction Act & the Battery Market

Projections like the above were published long before the Inflation Reduction Act became law. In all likelihood, market growth and R&D upside have only increased.

We expect the climate bill to lead to a) higher production requirements in at least the next few years and b) a long-term increase in battery R&D spending.

Let’s take a closer look at the most relevant provisions.

Electric vehicle tax credits

The Act includes tax credits of up to $7,500 per new electric vehicle and $4,000 per used one, depending on the buyer’s income. Critically, starting in 2023, the legislation removes the current cap of 200,000 new vehicles per manufacturer.

In theory, this offsets most of the approximately $10,000 premium for new EVs versus industry average prices. This could result in at least three scenarios:

- A larger pool of potential buyers, resulting in faster growth than the predictions mentioned earlier.

- Expedited purchases by the same underlying group of buyers who would otherwise have saved for another six or twelve months.

- Manufacturer price hikes in response to greater purchasing power, resulting in higher-than-expected revenue growth but middle-of-the-road unit growth.

These scenarios aren’t mutually exclusive, but all assume the auto lending market forestalls its brewing crisis, which lies outside the scope of the IRA.

Other tax & investment incentives

EV tax credits steal headlines, but the IRA also dedicates hefty amounts to several related programs:

- $20 billion in loans for “clean vehicle” production sites.

- $10 billion in investment tax credits for general “clean technology” manufacturing facilities.

- $2 billion for clean energy research at National Labs.

All the above are poised to stimulate sales of standalone energy storage, a multitude of industrial products, and other battery-dependent goods in addition to consumer electric vehicles.

In doing so, these general clean-energy incentives may open the door to outside capital for firms like many of our customers.

How SH Scientific Equips Battery Innovators

For battery researchers and manufacturers, the climate bill points toward larger addressable markets and therefore higher potential returns on R&D spending—not to mention sector-wide job growth.

So, as a maker of lab equipment, how can we support your innovation in this burgeoning field?

Tube furnaces

From standard Li-ion battery cathodes to cutting-edge monolayer graphene, thermal treatment is essential to production and research.

For instance, ceramic components may require sintering at temperatures approaching 2000°C with uniform heat throughout the chamber. And sensitive processes like chemical vapor deposition call for impeccable vacuum and inert gas control.

Our tube furnaces deliver high performance and unrivaled value for delicate processes and high-stakes research.

Vacuum muffle furnaces

Consistent heat treatment at a large scale is an obstacle for almost all research labs.

Most opt for a tube furnace for complete atmospheric control, but it comes at the cost of sample size. And standard muffle furnaces provide much more capacity per dollar, but their squared edges make inert gas saturation challenging.

We’re proud to have developed something that offers the best of both worlds.

Our vacuum muffle furnace integrates a vacuum pump and inert gas management into the larger chamber of a muffle furnace, for highly consistent saturation with ample space for more and larger samples.

A Trusted Supplier Since 1982

Every SH furnace provides fully programmable temperature control, with rapid heating/cooling and high uniformity you can trust.

We’re proud to offer Korea-built, USA-supported equipment to today’s leaders in energy storage research.

For technical information, OEM/ODM inquiries, or a custom quote, please contact us today.